How to agree to your brand partner's MSA, set tax rates, and start receiving payments

What is an MSA, and why do I need to sign it?

A Master Services Agreement (MSA) is a legal contract that defines the terms of your business relationship with both Lumanu and the brand partenrs (Payors) you work with through the platform. It sets clear expectations around responsibilities, services, and payments.

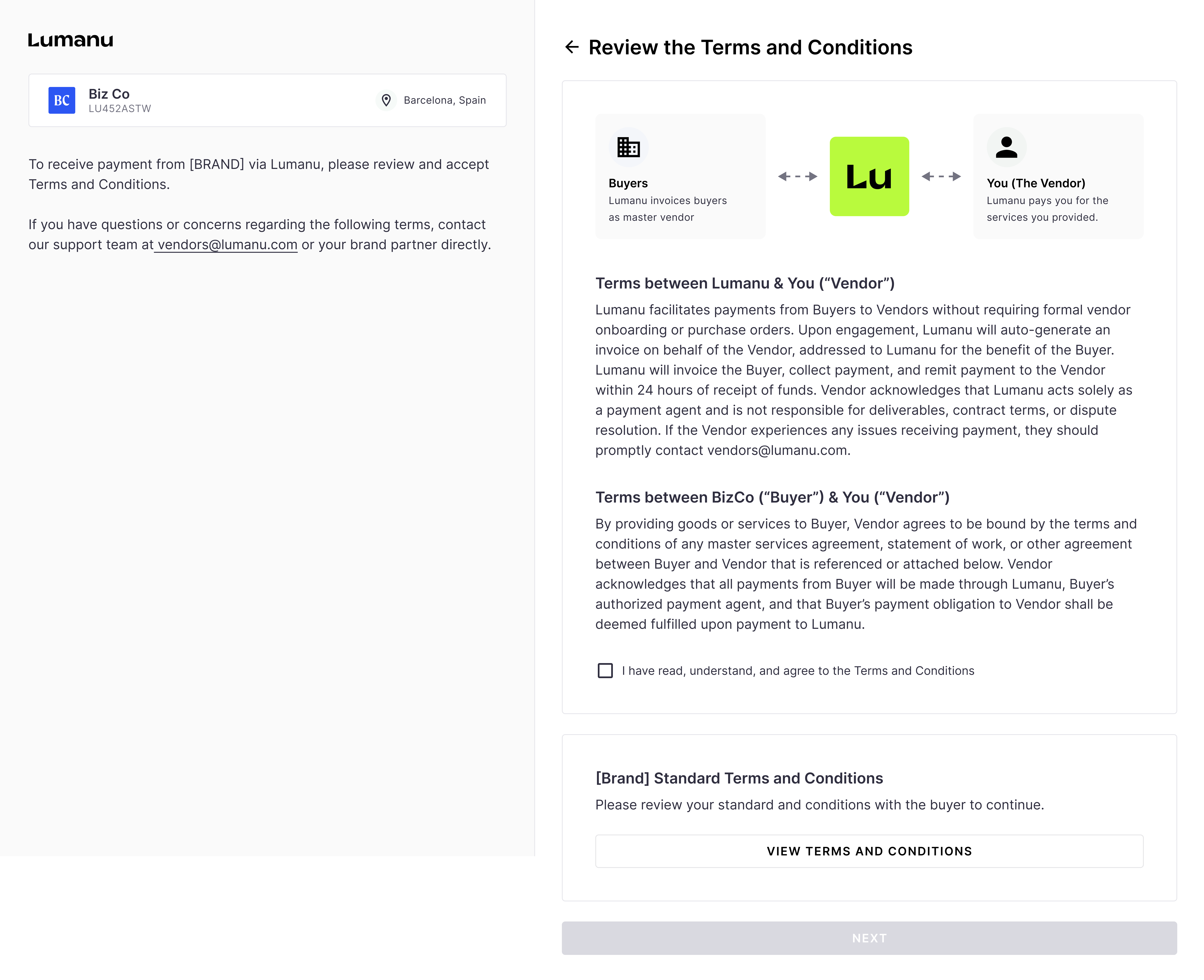

When working with a brand partner through Lumanu, you’ll be asked to agree to:

Lumanu’s MSA – This allows Lumanu to securely facilitate payments to you.

Your brand partner’s MSA (Payor MSA) – This authorizes the client to send payments to you via Lumanu.

You'll need to accept an MSA for each client you work with to ensure payment processing can begin.

How to agree to an MSA and start receiving payments

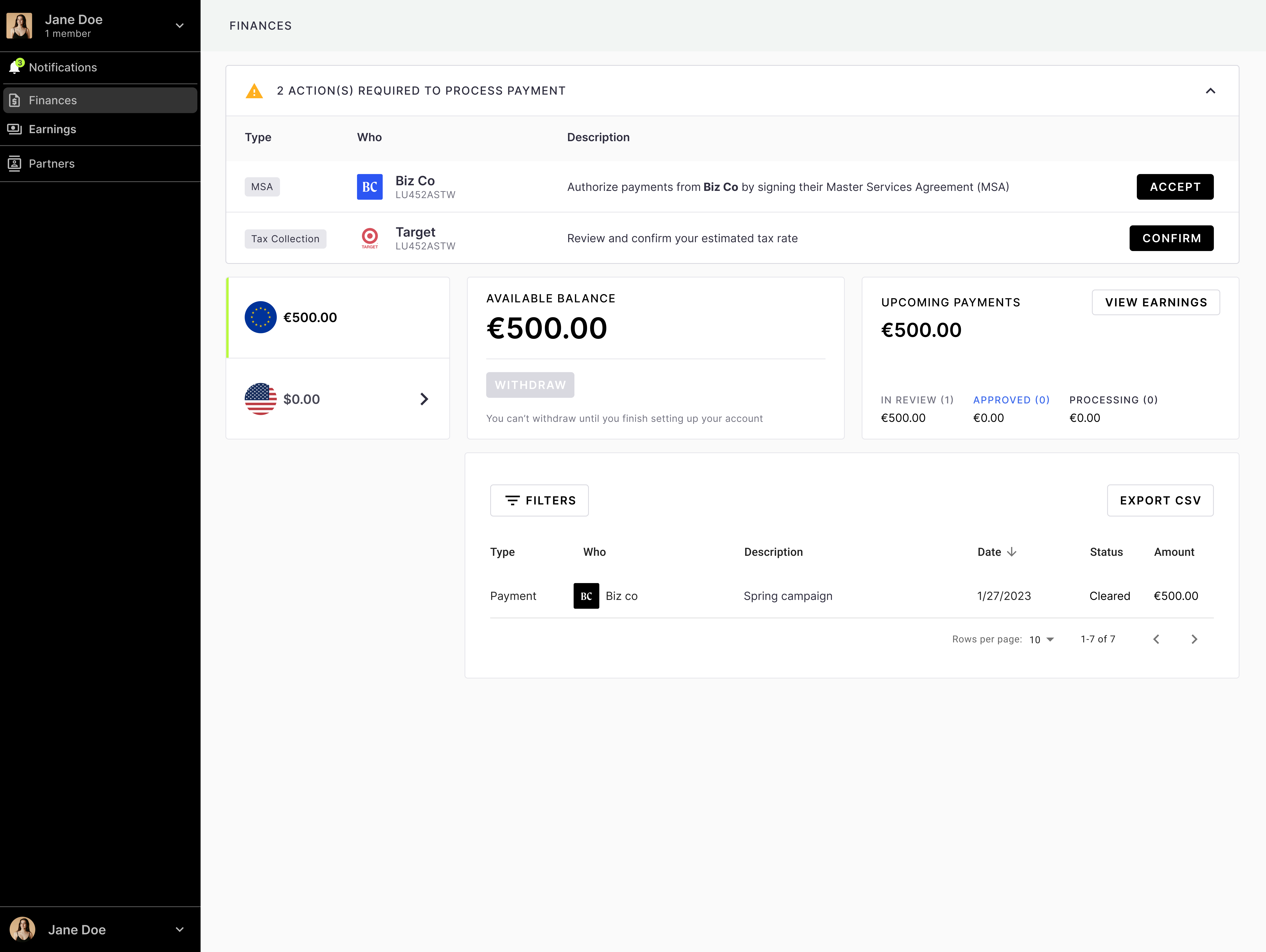

Log into your Lumanu vendor account.

Go to the Finances tab.

If any MSAs are pending, you’ll see a banner prompting you to review and complete them.Click “Accept” next to the pending MSA.

Review the terms and conditions, then agree to proceed.

Once all MSAs are accepted, you’ll be ready to move on to tax setup.

Tax Rate Confirmation

After you complete your MSA(s), Lumanu will use the tax information you’ve provided to determine whether local taxes apply to your payments.

Review your tax status:

If you’ve already submitted tax info and are registered for taxes, Lumanu will generate an estimated tax rate for you to confirm.

If you’re not registered, you’ll simply click Next to proceed.

If you haven’t submitted tax info yet, you’ll be prompted to do so before moving forward.

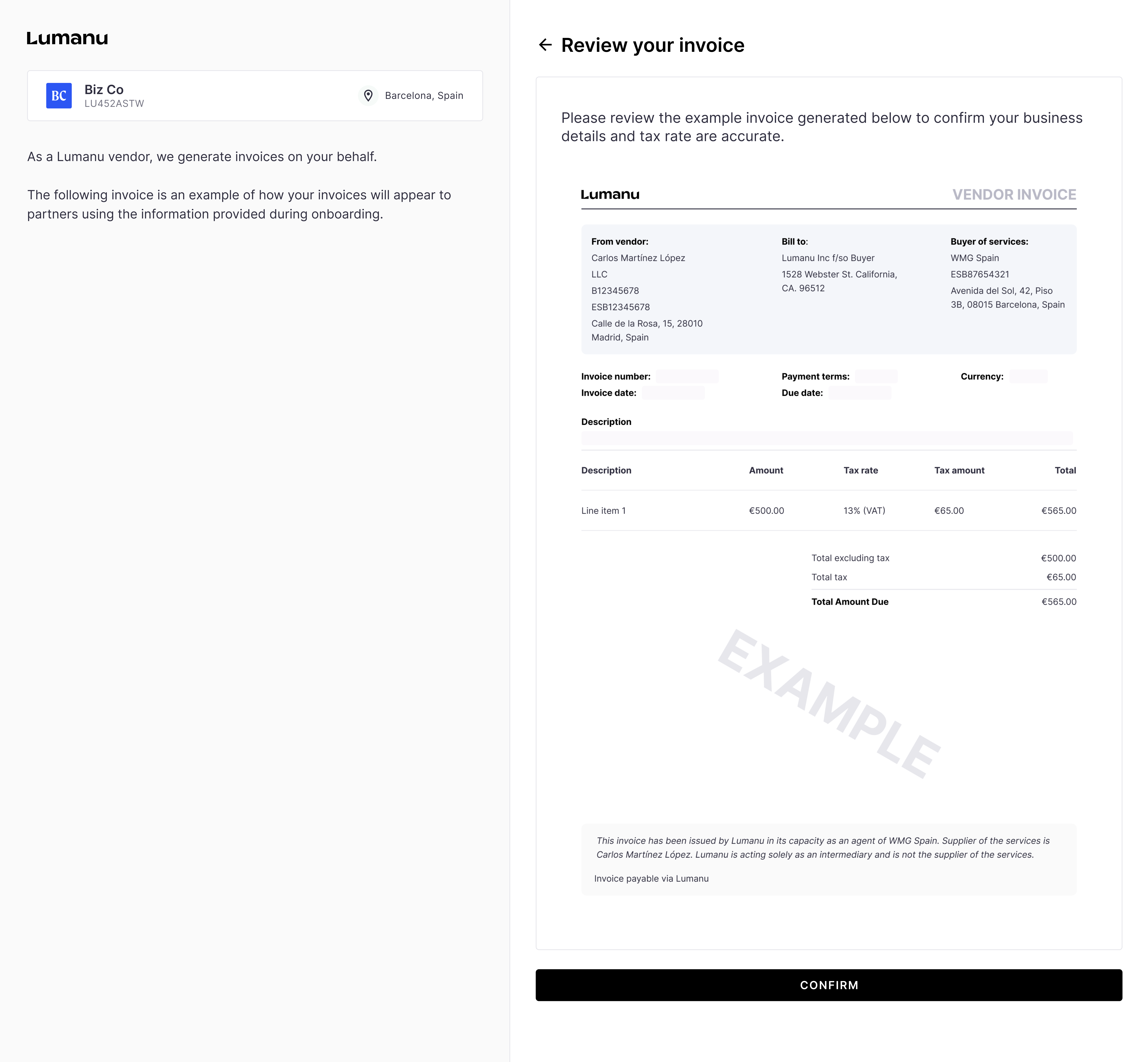

Preview your invoice:

Click Next to see an example invoice showing how your information and tax rates will appear to clients.Confirm your invoice details:

Make sure your business name, tax registration info, and rates look correct. Once confirmed, you’re all set to start receiving payments from your brand partners.