How to submit your International tax information

Before withdrawing funds from Lumanu, users are required to submit their tax information to Lumanu. Lumanu is set up as a third-party settlement group, meaning we handle tax paperwork on behalf of our clients.

*If you are U.S.-based, please refer to our How to submit your U.S. tax information resource.

To submit your Non-U.S. tax information:

Login to your Lumanu account and navigate under the Finances page.

A banner will populate at the top of the page prompting you to complete account setup. Click Finish setup.

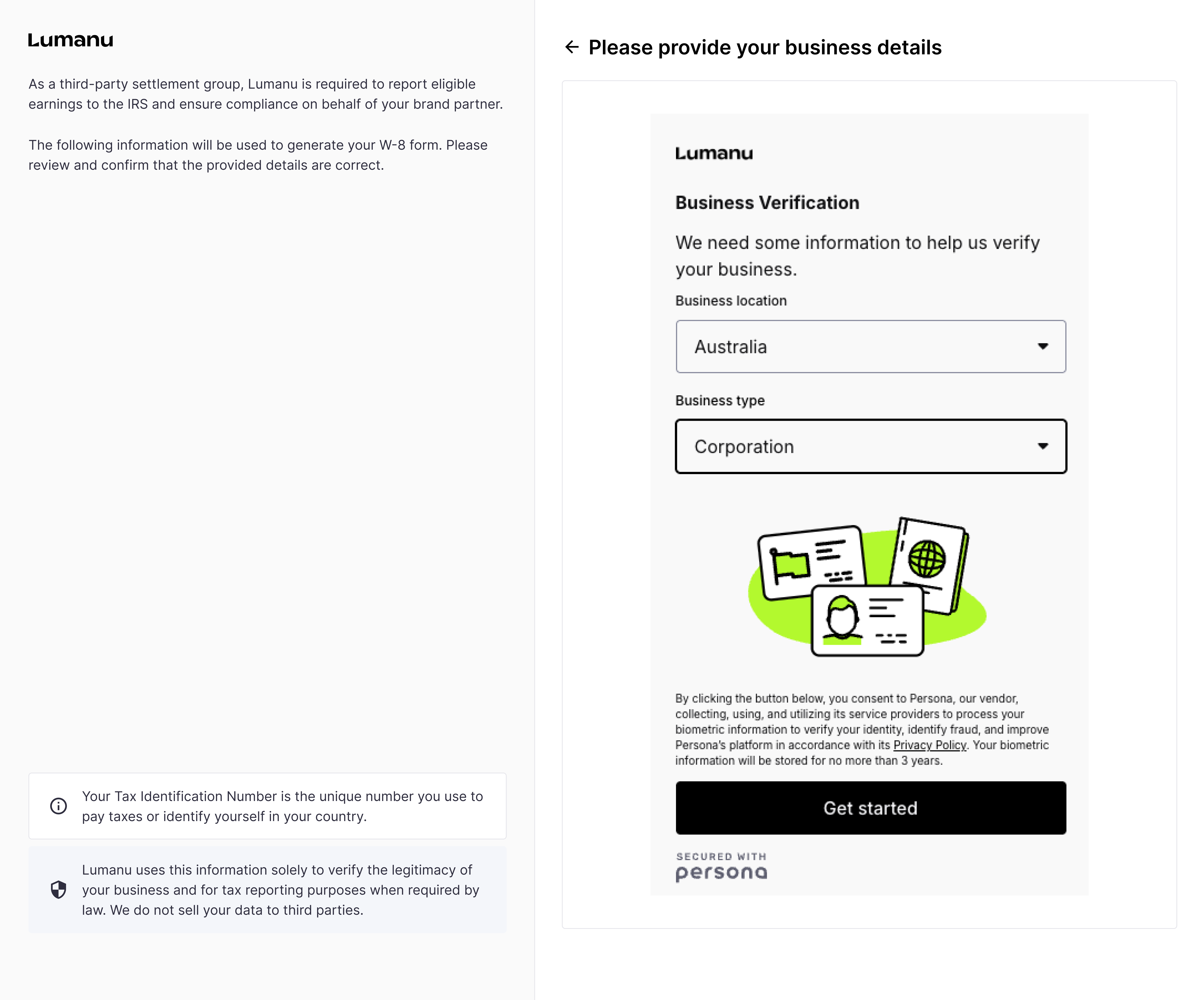

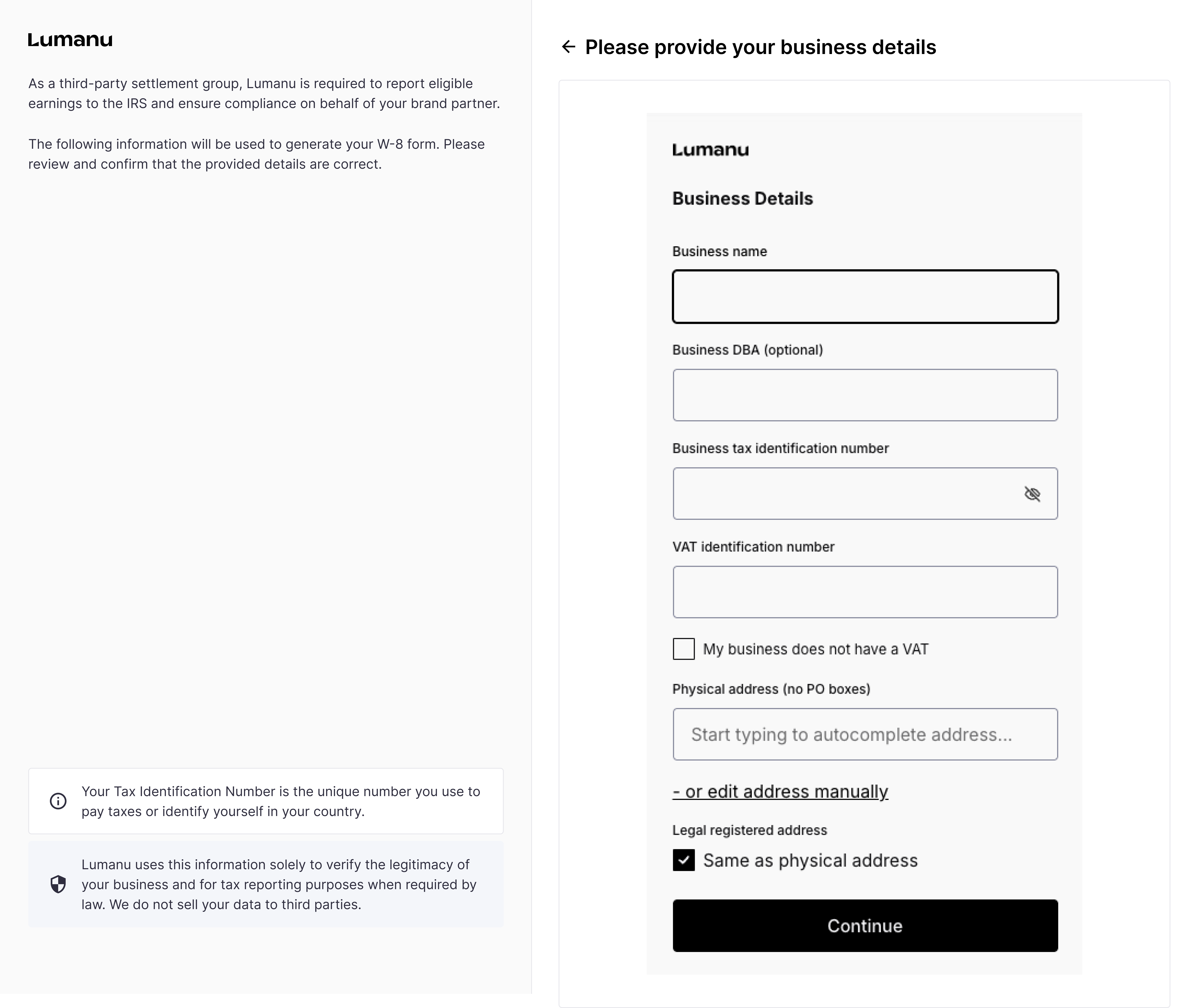

Lumanu will direct you through a series of questions about your business to verify the legitimacy of it.

*If you do not have access to the information required, gather it from your company’s business officer or have them complete the verification process in order to proceed.

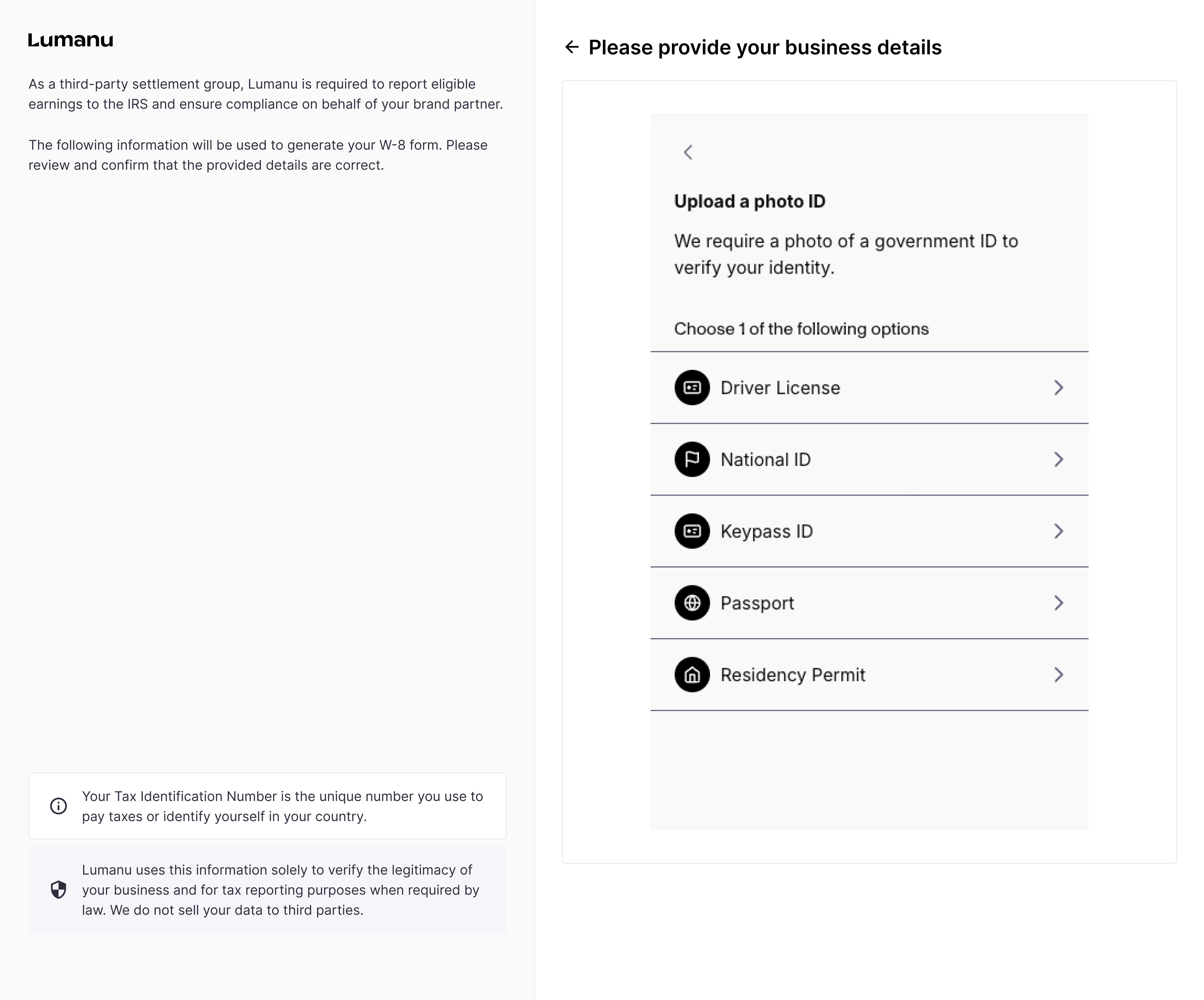

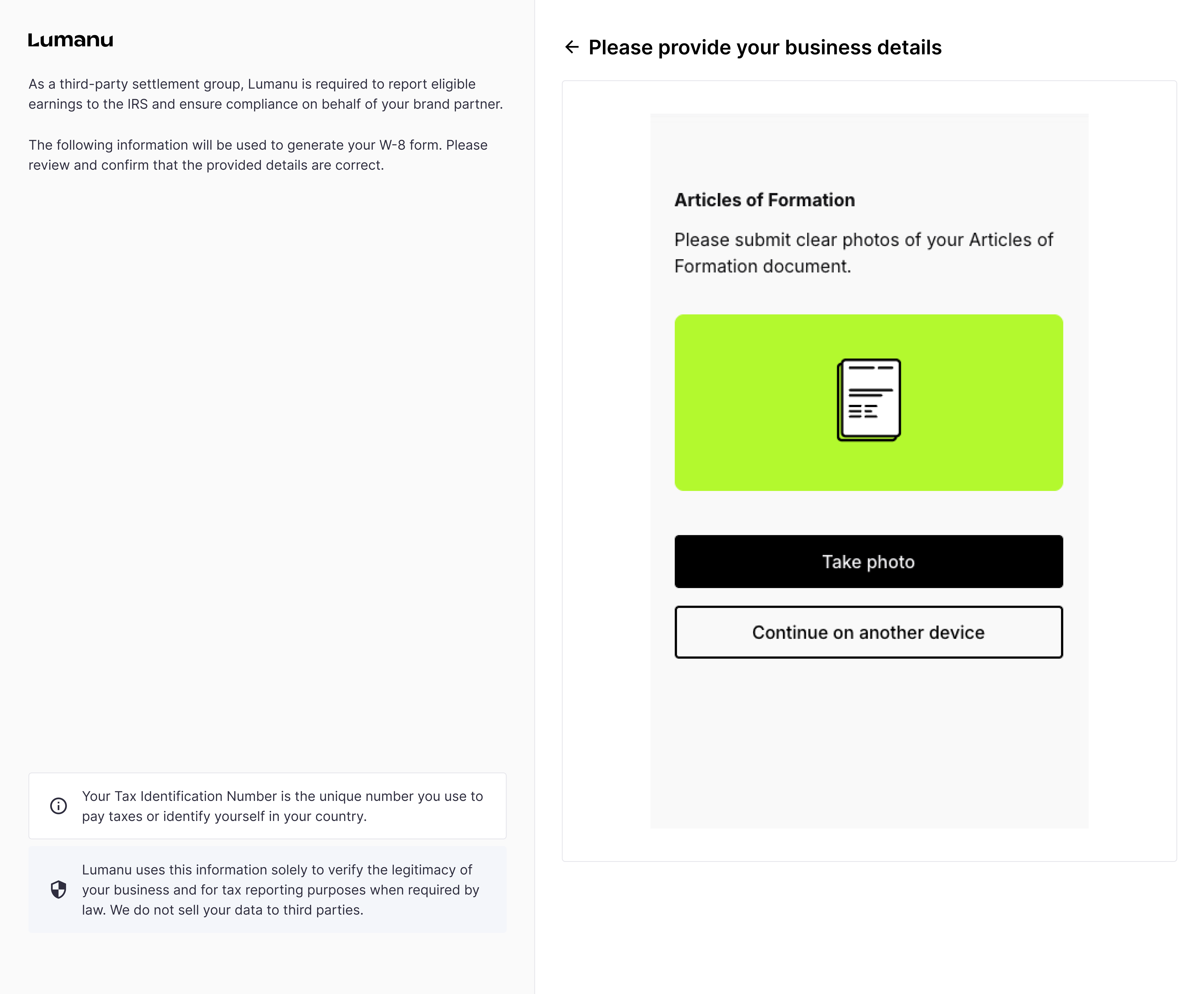

Lumanu will request a form of identification and/or articles of formation in order to complete business verification.

*All forms of identification and Articles of Formation are manually reviewed by our dedicated support team. You’ll receive an email regarding your verification status within 2-5 business days.

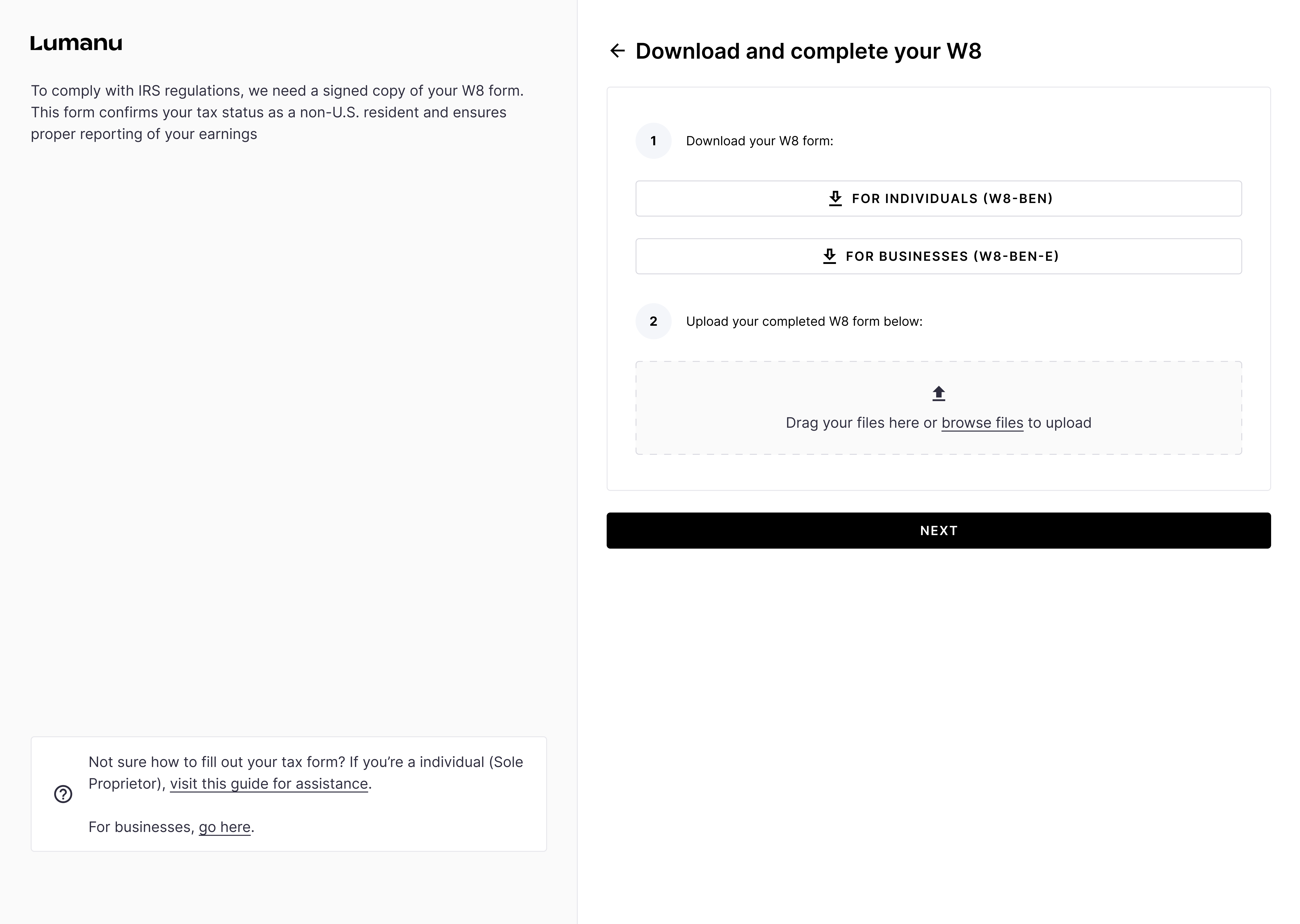

Once your business details are received, you will be directed to download, fill out, and re-upload a completed W8 form.

Your submitted W8 will be manually reviewed by our support team within 2-5 business days. If we were unable to accept the W8 for any reason, you’ll be emailed and informed of the reason why.

Once your tax document is received and verified, you will be able to transfer your funds out of your Lumanu wallet to your bank, debit card, or PayPal account.