Understanding conversion rates when withdrawing funds

When you withdraw funds from Lumanu, the amount you receive can vary depending on the currency of your Lumanu Wallet and the currency of your withdrawal destination.

This article explains how conversion rates work, when they'll be applied, and how you can review the conversion before confirming your transfer.

When a conversion happens

If you withdraw to an account in a different currency than the one you were paid in (e.g., you were paid in USD but withdraw in GBP), a currency conversion will be applied.

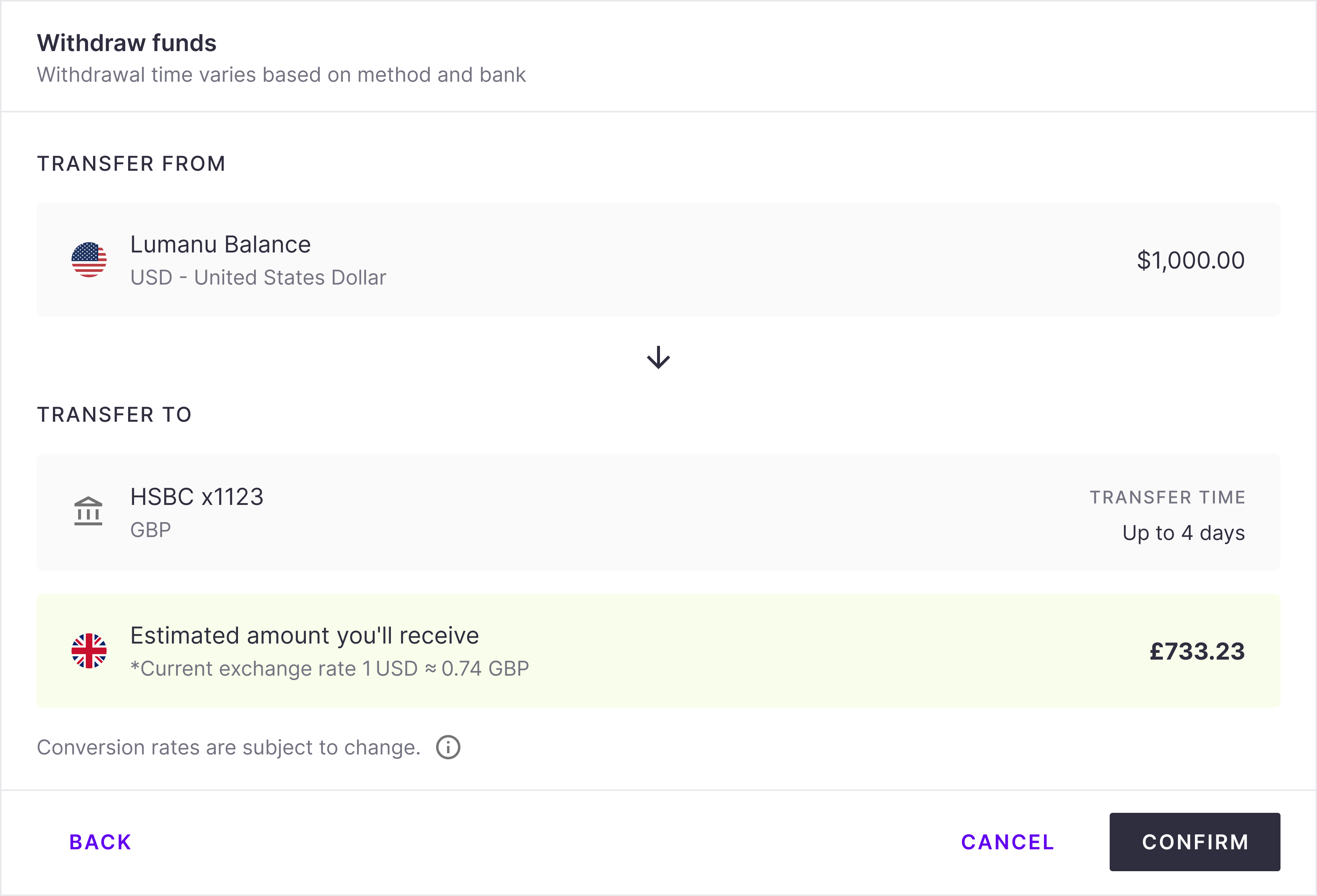

The estimated conversion rate and resulting amount you’ll receive are shown before you confirm the withdrawal.

You’ll see:

Withdrawal amount in your Lumanu balance currency (e.g., $1,000 USD)

Applicable fees (if any)

Estimated amount in your local currency (e.g., £733.23 GBP)

Once your withdrawal is fully processed, you'll see your final rate listed under your transactions.

Why conversion rates can fluctuate

Currency exchange rates change constantly and can be influenced by market activity, time of day, and other financial factors. Because of this:

The amount you receive may differ slightly between the time you start and complete a withdrawal.

Conversion rates are subject to change, and Lumanu provides an estimate at the time of withdrawal.

The conversion rate in Lumanu is different from the rate I found online. Why is that?

The rate you see on Google, Oanda, etc. is called the mid-market rate. It's the rate that very large financial institutions, like banks, use when they trade currencies among themselves. Businesses, including Lumanu, don't receive this rate when converting currency and transactions are subject the currency conversion rates of our banking partners.